How Strategic Marketing Planning Can Elevate Private Equity Investments

Private equity firms seek to maximize the value of their portfolio companies. Developing a data-driven marketing plan enables firms to expand market reach, accelerate growth, and build equity in portfolio companies.

An integrated strategy and execution plan allows PE firms to penetrate new segments, optimize pricing, create new revenue streams through products/services, and elevate brand positioning. With marketing working hand-in-hand with financial and operational enhancements, private equity firms can substantially boost the valuation multiple of their investments when it comes time for exit.

This blog will explore how a tailored strategic marketing plan and execution plan can become a crucial point of leverage for private equity firms.

The Value of Marketing Strategy for PE Investments

PE firms acquire businesses with the goal of selling them at an increased valuation multiple.

This requires expanding the earnings base. An income statement focusing on the top-line (revenue growth) and the bottom-line (profitability) is imperative.

An effective marketing plan addresses leveraging data, competitive research, and customer insights. Strategic marketing unlocks new customer segments, increases share of wallet with existing segments, optimizes pricing frameworks, and enables new product development. The result is accelerated organic growth and higher valuations.

1. Identify high-potential target markets and opportunities

A strong marketing plan involves in-depth market research and analysis to identify emerging trends, high-growth sectors, and potential target segments. This knowledge allows private equity firms to select the most promising investment opportunities that align with their objectives and areas of expertise.

2. Support value creation within portfolio companies

Private equity firms can provide portfolio companies with strategic guidance and resources to boost their marketing capabilities. This can include expanding into new markets, developing new products/services, improving branding and messaging, implementing digital marketing campaigns, and more. Driving growth and value creation makes the investment more attractive and facilitates attracting potential buyers or investors.

3. Enhance exit opportunities

Savvy marketing, branding, and positioning makes portfolio companies more visible to potential acquirers when planning for exit. A strategic marketing plan ensures the company can compellingly communicate its growth story and achievements.

4. Aid in capital raising efforts

A thoughtful marketing plan helps private equity firms articulate their investment thesis, competitive advantages, and growth opportunities to limited partners and prospective investors. This supports fundraising efforts for future private equity funds.

5. Facilitate due diligence

When evaluating potential deals, incorporating marketing analysis provides critical insights into the target company’s market position, competitive strengths and weaknesses, brand reputation, and growth prospects.

6. Manage reputation and industry voice

Strategic marketing and PR help private equity firms build brand equity, maintain a prominent industry voice, and manage reputation. This strengthens their profile and positioning.

Structuring a Strategic Marketing Plan

An effective strategic marketing plan follows a structured process:

Market Research

- Conducting market sizing analysis to quantify total addressable market and market share potential.

- Identifying customer demographics, behaviors, needs, and purchase drivers through surveys, interviews, and data analysis.

- Uncovering changing market trends, new technologies, competitive landscape shifts, and regulatory factors.

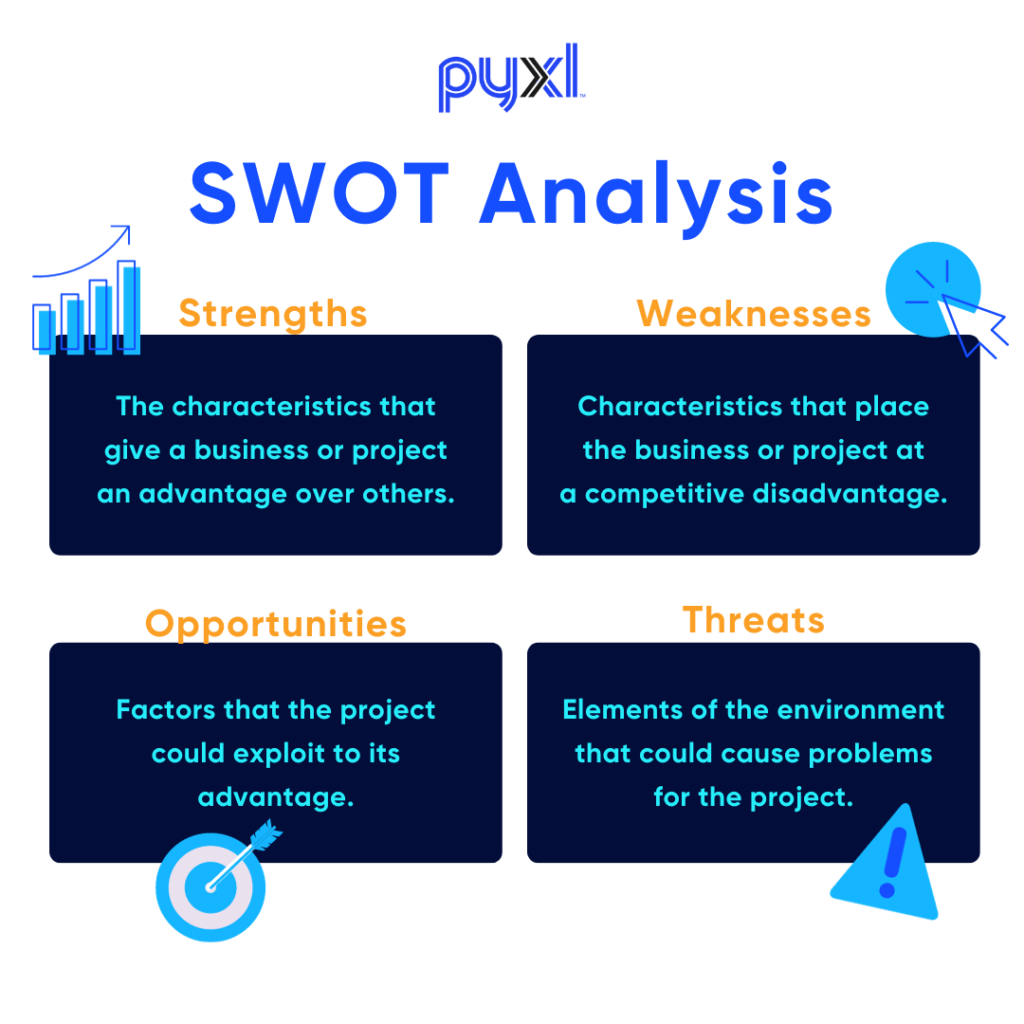

- Performing SWOT analysis to surface internal strengths/weaknesses and external opportunities/threats.

- Synthesizing research into key insights on growth potential, target segments, positioning, and value propositions.

Goals Setting

- Translating research and insights into tangible growth, revenue, and market share targets over the investment lifecycle.

- Setting specific objectives for new customer acquisition, retention, average deal size, lifetime value, etc.

- Aligning marketing goals to the overall investment thesis and projected return multiples.

- Gaining consensus among stakeholders on ambitious but achievable marketing goals.

Strategy Definition

- Formulating differentiated brand positioning strategies that resonate with target segments.

- Defining a messaging strategy focused on key customer needs, motivators, and buying criteria.

- Outlining strategies for market segmentation, buyer journey mapping, and omnichannel presence.

- Developing integrated strategies across the marketing mix – product, pricing, promotion, and place (distribution).

Tactics Development

- Detailing initiatives across areas like digital marketing, content creation, events, email campaigns, partnerships, etc.

- Translating strategies into specific sequences of tactical programs ready for execution.

- Assigning budget, timelines, responsibilities, and success metrics to each program and initiative.

Budgeting and Resource Allocation

- Developing marketing budgets aligned to growth objectives for each business line, campaign, channel, etc.

- Ensuring budgets are right-sized – sufficient to drive results but disciplined to maintain profitability.

- Evaluating in-house vs outsourced resourcing to balance costs, capabilities, and control.

- Investing in foundational infrastructure like customer relationship management (CRM) systems, data warehouses, and analytics tools.

- Hiring specialized talent across areas like branding, digital marketing, content creation, and analytics.

- Structuring incentive plans to align marketing teams to investment return goals.

Execution Planning

- Breaking down strategy deliverables into phased projects and campaigns with detailed requirements, timelines, budgets and KPIs (Key Performance Indicators).

- Constructing comprehensive project plans spanning research, creative development, technical implementation, quality assurance, launch, and performance tracking.

- Developing nimble workflows to manage a large portfolio of ongoing marketing initiatives.

- Orchestrating agency and vendor dependencies to coordinate program delivery.

Tracking and Optimization

- Establishing KPI dashboards to monitor marketing performance on a real-time basis across channels, campaigns, segments etc.

- Setting procedures for regularly reviewing results, identifying variances, and taking corrective actions.

- Developing continuous rapid optimization approach across a portfolio of initiatives based on outcomes.

- Adjusting resource allocation and investments to double down on highest performing programs.

This rigorous approach ensures marketing activities align to investment goals and key value creation levers. Ongoing optimization also adapts plans to ever-evolving market dynamics.

Conclusion

As PE firms look to rapidly scale marketing across their growing portfolios, engaging with specialized agencies provides valuable strategy and execution capabilities without the overhead of large internal teams.

At Pyxl, we offer end-to-end marketing campaign development, from strategic planning grounded in data-driven market insights, to conceptualizing creative campaign ideas, orchestrating detailed execution across digital marketing and more. Our creative teams can quickly design supporting assets across web, print, video, and social media. This allows firms to ramp marketing rapidly across their portfolios while retaining alignment with investment objectives. With the right agency partner, your PE firms can execute sophisticated marketing plans without significant fixed costs and HR risks.

The time is now for private equity firms to embrace strategic marketing as a core competency. Developing data-driven plans will enable you to unlock the full potential of portfolio companies, enhance returns, and boost exit valuations. Our team has deep expertise across PE marketing strategy development and execution. Contact us today to discuss how we can help you structure a customized plan tailored to your investment goals and portfolio mix. Let’s start the conversation!

Updated: May 13, 2025

Pramita Pramod

Pramita Pramod Kati Terzinski

Kati Terzinski Erin Murray

Erin Murray