The Role of Digital Marketing in Private Equity Value Creation

How can we drive value at a faster pace? This is the pressing question that we, in the private equity (PE) sector, frequently contemplate. In a recent industry survey, out of almost 200 PE professionals, a significant 63% are actively exploring alternative methods for value creation.

In this line of work, amplifying the value of your portfolio companies isn’t just an objective—it’s the metric by which you assess performance and benchmark success.

So, where should the focus be? The answer is loud and clear: digital transformation. To highlight the importance, consider this data point from the same survey: an overwhelming 84% of our peers believe that digital infrastructure is essential for transformation projects to succeed.

Let’s examine how we can enhance value for our investments more effectively using strategic digital marketing, while focusing on the three foundational pillars of value creation.

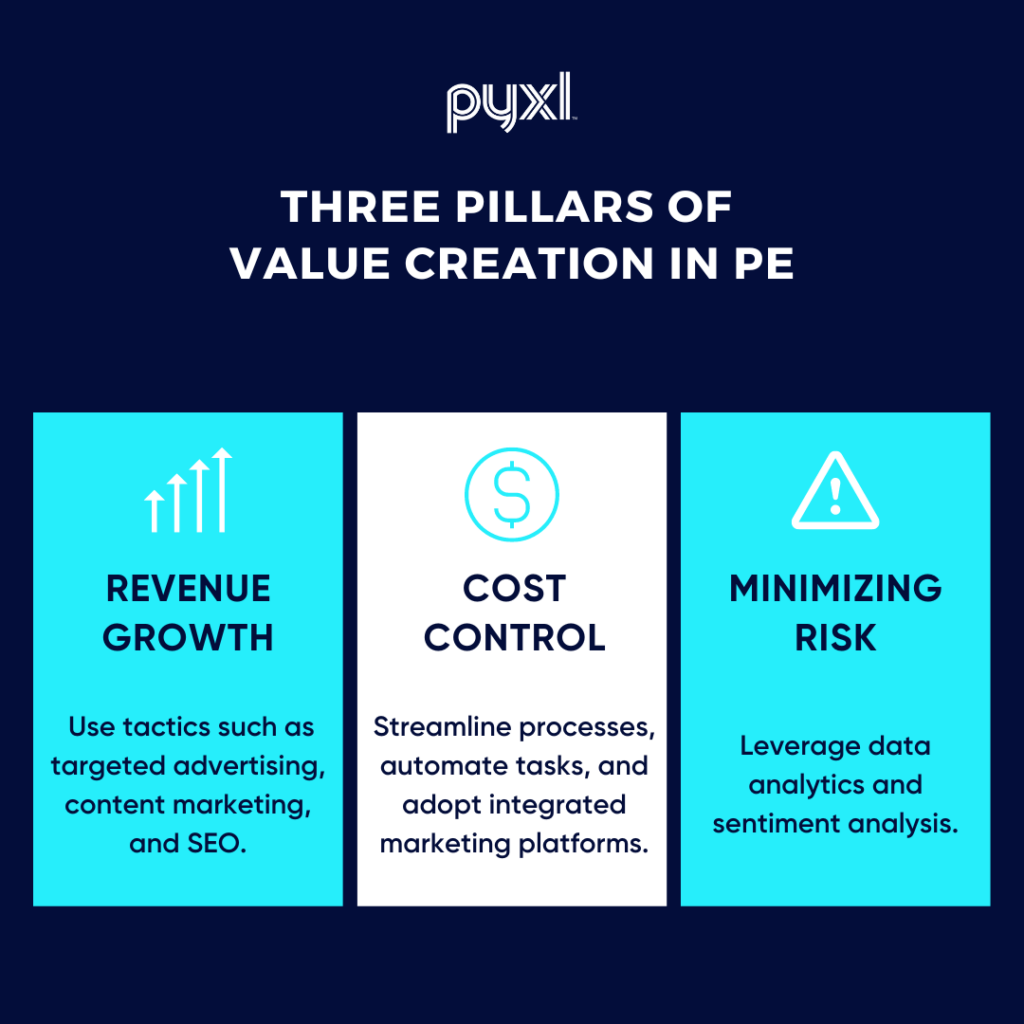

The Three Pillars of Value Creation in PE

Value creation in private equity isn’t one-dimensional. To position your PE firm at the forefront of value creation, consistency is key across three fundamental areas: revenue growth, cost control, and minimizing risk.

Revenue Growth

With digital marketing, PE firms have a powerful arsenal to propel portfolio companies forward, faster. Tactics such as targeted advertising, content marketing, and SEO not only bolster brand presence but also amplify customer acquisition. Moreover, by tapping into data-driven strategies, firms can identify opportunistic markets, harnessing them for exponential growth.

Cost Control

Efficiency in the digital realm translates to a lean and potent technology stack. By streamlining processes, automating tasks, and adopting integrated marketing platforms, PE firms can instill cost-effective practices in their portfolio companies, ensuring that every marketing dollar has a tangible and lasting impact.

Minimizing Risk

Risk isn’t just about financial vulnerabilities; it extends to brand perception, online reputation, and the evolving digital landscape. By leveraging data analytics and sentiment analysis, PE firms can gain real-time insights, allowing them to navigate their portfolio companies away from potential pitfalls and towards opportunities.

Incorporating digital marketing strategies to support these three pillars not only ensures value creation but also positions PE firms and their portfolio companies for sustained success in a dynamic evolving marketplace.

Digital Marketing’s Influence on Minimizing Risk

Here’s where digital marketing, with its precision-focused tools and strategies, becomes the unsung hero. It’s not just about reaching the audience; it’s about smartly navigating the digital realm to ensure stability, predictability, and, most importantly, reduced risks.

Marketing Automation

Role: Utilizes software to automate repetitive marketing tasks, ensuring timely and relevant messaging to the right audience.

Value Added for PE Firms:

- Operational Efficiency: Reduction in manual intervention, coupled with diminished human error, results in a streamlined marketing operation

- Data-Driven Decision-Making: Automated tools provide insights, which translate to more informed marketing strategies, reducing unforeseen pitfalls

- Enhanced ROI: Automation maximizes the value from every campaign by targeting and retargeting the right audience segments, thereby optimizing the return on marketing investments

Data Analytics and Insights

Role: Captures, processes, and interprets digital footprints to inform marketing strategies.

Value Added for PE Firms:

- Focused Strategy Development: By understanding user interactions and behaviors, firms can target the most receptive segments

- Cost Efficiency: Reduces wasteful spending by eliminating non-performing initiatives, ensuring that every marketing dollar is well-spent

- Dynamic Adjustments: Real-time feedback allows for quick refinements to strategies, ensuring continued relevance and engagement

Digital Transformation

Role: Revolutionizes organizational operations through the integration of digital technology in every area.

Value Added for PE Firms:

- Overhead Reduction: Transitioning to digital platforms and tools can significantly cut down on infrastructure and operational costs

- Agility: Adopting digital practices leads to a more adaptable business model, allowing for quick pivots in response to market changes

- Optimized Resource Utilization: Digital tools and collaboration platforms enhance efficiency, resulting in faster, cost-effective processes and improved value creation

Digital Strategies to Drive Revenue Growth

The digital world offers an abundance of opportunities to reach audiences like never before. Leveraging these digital channels is key for PE firms seeking to drive growth and boost the value of their portfolio companies. Here’s how each strategy contributes:

SEO and Content Marketing

Role: Improves online visibility and drives organic website traffic.

How it Drives Revenue:

- Organic Traffic: Well-optimized websites attract more visitors without additional ad spend, translating to potential customers

- Establishing Authority: High-quality content positions a company as an industry leader, leading to increased trust and business interactions

- Lead Generation: The traffic and authority earned from SEO and content marketing are long-lasting, ensuring a steady flow of potential leads over time

Paid Advertising

Role: Promotes a brand or product through paid channels to reach specific audience segments.

How it Drives Revenue:

- Instant Visibility: Immediate appearance on platforms or search results means instant traffic and potential sales

- Precision Targeting: Reach audiences based on demographics, interests, and behavior, ensuring higher conversion probabilities

- Adaptability: Real-time adjustments can be made based on performance, optimizing for best results

Social Media

Role: Engages audiences on platforms where they spend a significant amount of time.

How it Drives Revenue:

- Direct Engagement: Interact and build relationships with potential customers, fostering trust

- Brand Promotion: Satisfied customers can share and promote products/services, effectively acting as brand ambassadors

- Immediate Feedback: Understand audience sentiment and adapt strategies on-the-fly

Email Marketing

Role: Communicates directly with potential or existing customers through their inboxes.

How it Drives Revenue:

- Tailored Messaging: Send content and offers that resonate with individual recipients, increasing engagement

- Remarkable ROI: Consistently, email marketing yields one of the highest returns for every dollar spent

- Lead Journey: Systematic communication nurtures leads, moving them down the sales funnel to conversion

By leveraging these digital strategies effectively, PE firms can augment the revenue of their portfolio companies, solidifying their stance in the market and setting them on a path of sustainable growth.

Leveraging Digital for Effective Cost Control

For PE firms, it’s crucial not just to drive revenue growth but also to optimize cost structures within their portfolio companies. Through digital means, there are effective strategies to not only control but also reduce costs, ultimately leading to better profit margins and higher valuations. Let’s delve into how digital strategies play a pivotal role in cost control.

Process Automation

Role: Streamlines operations, often replacing manual tasks with automated systems.

Value for PE Firms:

- Labor Cost Reduction: Automating repetitive tasks means fewer labor hours are required, directly reducing payroll expenses

- Accuracy and Efficiency: Automated systems reduce human errors which can often lead to costly rectifications. This ensures tasks are done right the first time, saving both time and money

- Scalability: Once processes are automated, scaling becomes easier and more cost-efficient, as increased volume doesn’t necessarily mean proportionally increased costs

Data-Driven Decisions

Role: Employs analytics and insights to make informed decisions.

Value for PE Firms:

- Eliminate Unproductive Expenditure: By understanding what works and what doesn’t, companies can avoid spending on non-performing initiatives

- Optimized Marketing Budgets: Data insights help allocate marketing budgets where they have the highest impact, ensuring every dollar is well-spent

- Informed Business Strategy: Decisions backed by data reduce the chances of costly missteps in product development, service offerings, and market targeting

Efficient Resource Allocation

Role: Ensures resources—both in terms of manpower and capital—are used where they bring the most value.

Value for PE Firms:

- Maximized ROI: Analytics-driven resource allocation ensures the highest return on every resource, whether it’s an advertising budget, a team member’s time, or investment in technology

- Agility: Companies that can pivot resources quickly in response to market changes can reduce losses and capitalize on new opportunities faster

- Long-term Sustainability: Efficiently allocated resources pave the way for sustained growth and profitability, ensuring the longevity and continued value appreciation of the portfolio company

Through these digital avenues, PE firms can imbue their portfolio companies with cost-efficiency cultures. This not only strengthens their operational backbone but directly contributes to better financial performance and enhanced value in the eyes of investors and the market at large.

Key Takeaways

The quest for private equity value creation has found a powerful ally in digital strategies. From automation to in-depth analytics, the digital realm offers unparalleled opportunities to enhance the worth of portfolio companies, driving revenue growth, mitigating risks, and controlling costs more effectively than ever before.

Yet, while the potential of digital is vast, harnessing its full spectrum requires expertise. Navigating these intricate strategies and tools can be time-consuming and resource-intensive. This is where the value of a partnership with a seasoned digital agency becomes clear. Such a collaboration not only ensures access to the latest digital tools and insights but also offers tailored solutions, saving invaluable time and resources that can be redirected to core business activities.

At Pyxl, with our expertise, you don’t just get a service provider but a partner dedicated to maximizing the value of your investments. Pyxl is ready and equipped to make your investment potential a reality. Partner with us, and let’s craft a future enriched by digital excellence, together.

Updated: Apr 11, 2025

Taylor Farace

Taylor Farace Kati Terzinski

Kati Terzinski Erin Murray

Erin Murray