Mergers, Acquisitions, and Business Transformation: A New Paradigm for PE Investors

Mergers and acquisitions (M&A) have long been a key strategy for Private Equity (PE) investors seeking to drive returns. However, the traditional approach focused on cost-cutting and financial engineering is no longer sufficient in today’s dynamic marketplace. PE firms are now looking to business transformation as a new paradigm to systematically unlock value and competitive advantage across their portfolios.

Business transformation refers to making comprehensive changes across people, processes, and technology to substantially improve operations, customer experiences, and financial performance. With compressed hold periods and intense competition for deals, PE investors who embrace business transformation will be well-positioned to deliver differentiated returns on their investments.

This blog will explore how PE firms can integrate business transformation, provide specialized expertise during ownership, and leverage transformations to maximize exits. The implications are far-reaching, pointing to an evolution in how PE investors create value.

Adapting to the Evolving M&A Landscape

Mergers and acquisitions (M&A) have historically been used as opportunities to consolidate operations, cut out costs, and generate synergies. However, the nature of M&A has evolved in recent years. Cost-cutting and synergies are table stakes – companies now use M&A as a growth lever to access new capabilities, enter new markets, and accelerate innovation.

This changing landscape has implications for private equity (PE) investors. PE firms can no longer rely on traditional cost-cutting levers to drive returns. With compressed hold periods of 3-5 years, they need new ways to quickly create value in their portfolio companies after acquisition.

Business transformation has emerged as a key enabler for PE investors seeking to reposition acquired companies for growth and competitiveness. Transformations can strategically reconfigure business models, optimize go-to-market strategies, and rapidly scale digital capabilities. This unlocks new potential value that can be realized by addressing enterprise-wide changes, rather than relying on incremental optimization.

The ability to execute business transformations is becoming a competitive advantage for PE firms. Given the timeframe to realize returns, transformations must begin early and follow a precise methodology to improve likelihood of success. Leading PE firms are building specialized expertise and playbooks to lead portfolio companies through transformation for superior ROI.

Business Transformation in PE Investment

Business transformation refers to fundamental, cross-functional change initiatives that aim to substantially improve a company’s performance and competitive positioning. Transformations go beyond incremental improvements to reimagine entire business models, operating models, and customer value propositions.

Executed effectively, business transformations can yield dramatic benefits for PE portfolio companies:

- Cost optimization from process reengineering and automation

- Improved operations by reconceiving end-to-end workflows

- New business models that open additional revenue streams

- Higher customer lifetime value from enhanced experiences

- Faster growth by recalibrating go-to-market strategies

However, realizing these benefits requires an enterprise-wide change. Transformations involve people, process, and technology:

- People – organizational change management, upskilling talent

- Processes – redesigned workflows, updated policies

- Technology – new systems, data architecture, digitization

Here are the key phases in the business transformation process for a private equity investment:

Pre-Acquisition Phase

- Conduct commercial due diligence assessing growth potential, risks, and requirements for transformation.

- Develop detailed operational blueprint mapping required changes across people, processes, and technologies.

- Model the investment case and define metrics to track transformation progress.

100-Day Plan

- Roll out quick-win initiatives with immediate ROI impact in the first 100 days.

- Appoint transformation leadership and finalize a detailed implementation roadmap.

- Communicate the vision and gather buy-in across the organization.

Implementation Phase

- Execute changes to organizational structures, systems, policies, and capabilities per the roadmap.

- Manage cultural transition and align teams to new processes through training and coaching.

- Drive rapid operational improvements while maintaining day-to-day execution.

Value Creation

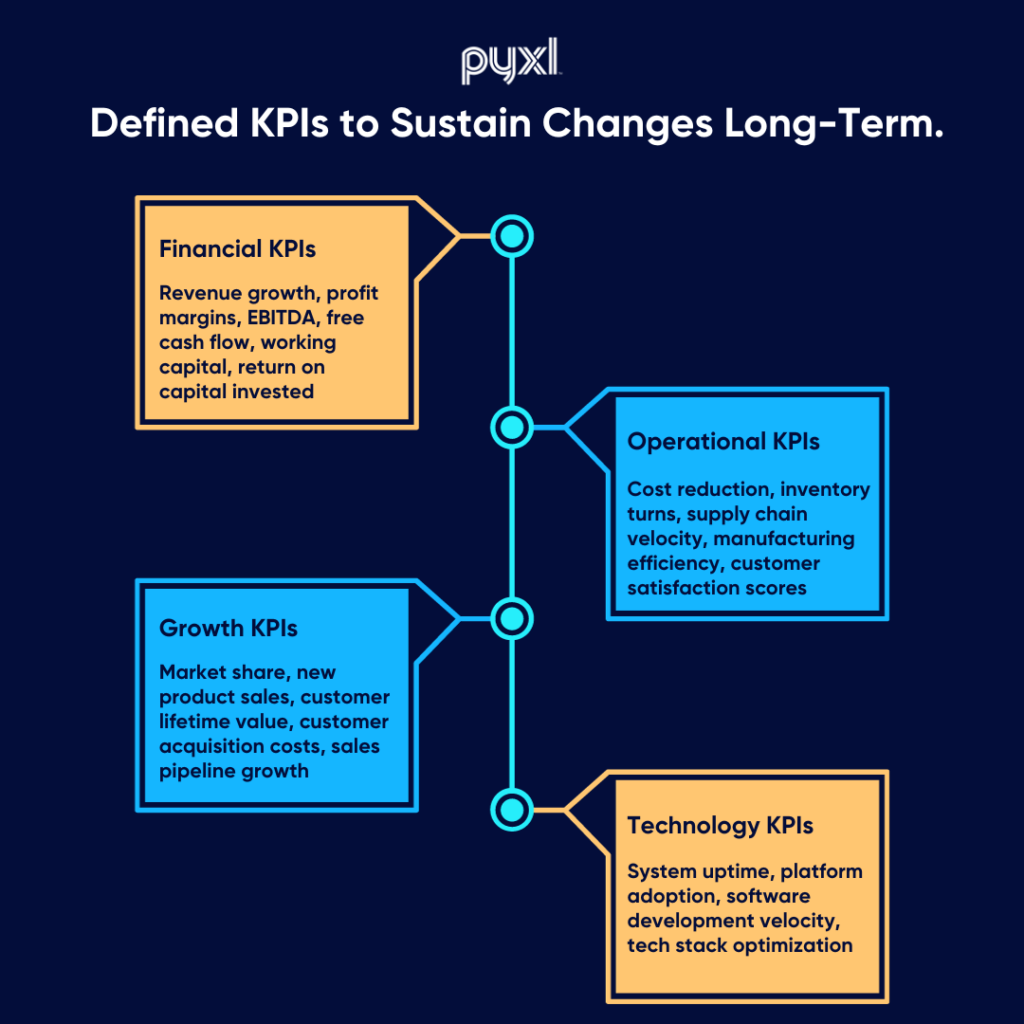

- Instill metrics-driven culture focused on defined KPIs to sustain changes long-term.

- Institutionalize capabilities for innovation and agility to support continuous improvement.

- Capture synergies, optimize operations, and scale to realize the investment thesis.

Exit Preparation

- Position company for exit by highlighting operational transformation, leadership team, and growth potential.

- Conduct operational due diligence and provide data room to validate consistent performance.

Undertaking transformation requires reshaping the core foundations of how a company operates. Piecemeal initiatives will fall short; the scope must be broad and integrated across functions. With proper coordination, transformations can propel significant improvements in how companies create and deliver value.

Building Transformational Capabilities

To effectively execute business transformations across their portfolios, PE firms need to build specialized transformational capabilities:

- Assemble internal strategic expertise in business transformations – from planning through implementation. This may involve forming a dedicated transformation team or partnering with management consulting firms skilled in spearheading major change initiatives.

- Deploy change management skills to lead portfolio company leadership and employees through complex transformations. Change readiness assessments, communication plans, training programs, and cultural alignment are critical to driving adoption.

- Develop transformation playbooks and methodologies that can be tailored for portfolio companies. These provide structured approaches for developing transformation strategies, carrying out diagnostic analyses, tracking execution, and measuring results. Playbooks codify best practices and create repeatable transformation processes.

Some key areas to cover in transformation playbooks include:

- Identifying transformation opportunities during diligence

- Defining the value creation thesis and metrics

- Planning the transformation program and timeline

- Creating aligned ownership and governance

- Managing the stakeholder communication strategy

- Conducting impact assessments across the organization

- Monitoring risks and mitigation plans

By investing in transformational resources and institutionalizing processes, PE firms can scale their capabilities to drive successful business transformations across multiple portfolio companies. This transforms their value creation approach.

Maximizing Exits Through Transformation

To maximize portfolio company valuation and exit multiples, PE investors can highlight the tangible impact of business transformations. By demonstrating quantifiable improvements in growth, competitiveness, and operations, they attract premium valuations.

PE firms should quantify performance gains, cost savings, and revenue growth resulting from transformation initiatives. This data showcases the strategic value unlocked and depth of the performance turnaround.

Buyers are looking for market leaders with differentiated capabilities and demonstrated growth. Positioning the company as competitively strengthened through transformation allows PE investors to command higher valuations from both financial and strategic acquirers.

The metrics and benchmarking data validate the sustainability of improvements for buyers, thus minimizing perceived execution risk. In this way, leading PE firms monetize the full value created through transformative changes made during ownership.

Key Takeaways

The traditional PE approach of cost-cutting and financial engineering is no longer enough to drive returns in today’s dynamic market. With shorter hold periods, PE firms need new ways like business transformation to rapidly create value in acquired companies.

Business transformation involves comprehensive changes across people, processes and technology to substantially improve performance. Leading PE firms are building specialized expertise in transformations, integrating it throughout the investment life cycle.

Transformations enable pursuing new business models, optimizing operations, boosting customer experiences and accelerating growth. Effective execution requires strong leadership, a focus on end goals, rigorous governance and change management.

PE firms should evolve their playbooks, from diligence to exit, to systematically identify, execute, and maximize transformation opportunities. Firms that build capabilities to lead transformations will gain significant competitive advantage and returns. Business transformation represents a new imperative for PE investors to generate the next wave of systematic outperformance.

Contact Pyxl

Pyxl helps leading PE investors build comprehensive transformation capabilities. From due diligence to exit, we provide the strategy, execution, and change management expertise to reimagine your portfolio’s performance.

With our proven, systematic approach, we can unlock transformational value across your portfolio. Don’t leave these outsized returns on the table. Contact us today to discuss your firm’s transformation readiness.

Updated: Nov 27, 2023

Pramita Pramod

Pramita Pramod Kati Terzinski

Kati Terzinski