Understanding and measuring the effectiveness of your ads is fundamental to paid media. Some of the data collected can be quite challenging to make sense of. For example, in 2020, online shopping by highly motivated shoppers drove the lowest cost per clicks (CPCs) ever recorded. In addition, due to economic uncertainty, many companies reduced their spending.

Did any of that make any sense? If yes, great! If not, that’s ok, let’s talk about it!

Intro to Cost-Per-Click

CPC is the performance metric that measures the overall cost per click of your pay-per-click (PPC) ads. Want to know how effective your ads are? Analyze your CPC. Search engines use cost-per-click (CPC) as an online advertising revenue model to bill advertisers based on the number of times visitors click on an ad and are redirected to the corresponding website.

Note: It’s not uncommon for people to confuse the terms PPC and CPC. You can read more about the differences between the two in our blog: PPC vs. CPC.

Understanding Cost-Per-Click

Cost per click is determined by two variables: the ads you’re competing against and your ad Quality Score. Based on your predetermined budget, bids are placed daily for all active PPC ads, either manually or automatically. From there, the ad with the highest bid will win the higher ad rank. Google will then couple that ad rank with the ad Quality Score (how engaging your ad is) to determine its CPC. For example, say your competitor has an ad with an ad rank of 16 while yours is ranked 20 with a Quality Score of 10. If you gave a daily bid of $2.00, you would generate a $1.61 CPC. That means you would pay $161 for every 100 clicks on your ad.

Typically the lower your CPC, the better. That means you have more clicks for your allotted budget, which could result in more potential leads. So earlier, when we said we saw the lowest recorded CPC in 2020 than ever recorded, most companies would agree this is an ideal situation because companies spent less while having more highly engaged customers. But, let’s dive deeper and take a look at how spend trends were affected post-pandemic below.

Making sense of the past

As mentioned before, the demand for online shopping increased significantly due to the pandemic and not being able to shop in stores. However, this increase in online shopping, and economic uncertainty, caused quite a bit of supply and demand issues that resulted in reduced ad spend. Due to this, retailers were able to engage highly motivated shoppers across different channels in a much less competitive environment. As a result, CPCs hit their lowest point in 2020 during the first months of the pandemic.

CPC trends have seen quite a bit of change over the past year and a half. According to Merkle, the US’s overall paid search growth rate returned to Q1-Q4 2019 levels in Q4 of 2020, likely because brick-and-mortar stores across the country have reopened. Approximately 10.0% of advertising spending grew year over year compared to the same quarter last year. Cost per click decreased by 0.3% after falling by 11% in the previous quarter and 38% in 2020. This statistic means online retailers are beginning to pay similar rates pre-pandemic for each click.

With all these fluctuations and changes in the market, what can we expect our CPC trends to be in the following year?

Trends in CPC this year

Increased personalization capabilities

In order to connect with your customers, you need to appeal directly to them through personalized advertisements. In a recent study, personalization drove a 25% increase in revenue for retailers who implemented the practice than those who didn’t.

Machine learning and artificial intelligence (AI) make it possible for customers to have automated and personalized shopping experiences. AI continuously collects data about how a customer shops, when they make purchases, and what they’re looking for in a product or service. With this data, you can create highly personal, targeted advertisements to meet the right prospects at the right time.

For example, a platform called PostClick allows for personalization on both pre-click and post-click ads. This personalization can also be through the landing page after the potential customer clicks the ads.

Platform competition

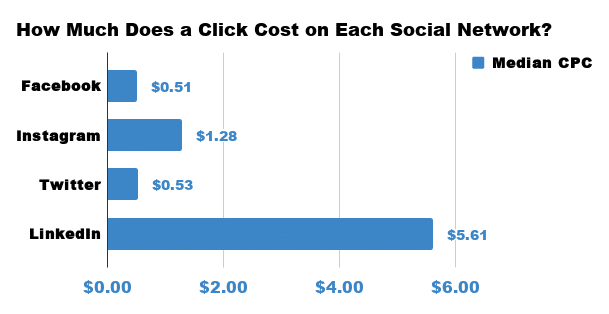

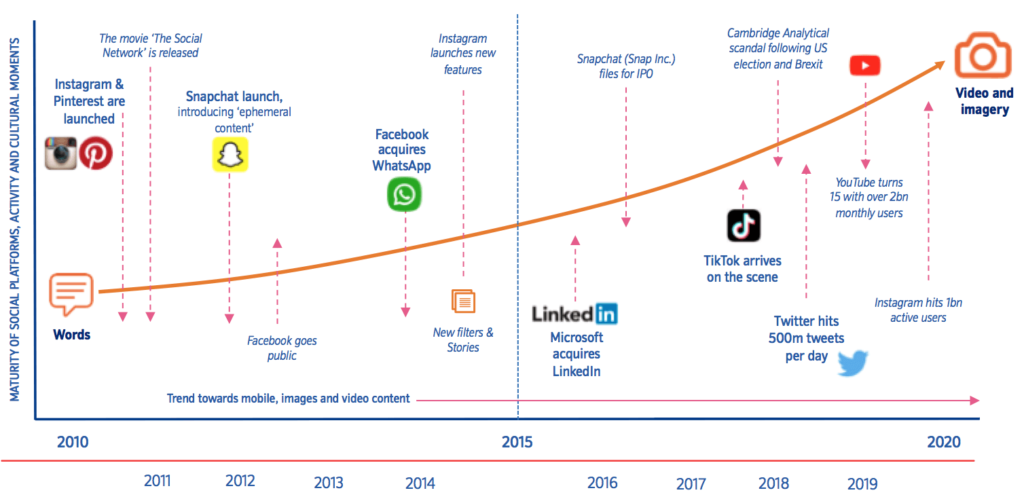

Digital advertising competition continues to grow with new platform features such as TikTok, Instagram Reels, and LinkedIn Stories providing more ways to engage a larger pool of potential prospects. Each social network vies for a lower CPC which can be displayed below. By the end of 2021, eMarketer.com forecasts that eCommerce sales would rise by 18% while brick-and-mortar retail would fall by 14%.

While emerging platforms like TikTok continue to grow in popularity, Facebook and Google continue to lead the way in advertising popularity. Justifiably so, as Google delivers a higher return on ad spends to 44% of marketers than any other company, is Facebook coming close behind, with 25% of marketers stating that they use it for their top-performing campaigns.

Overall, it is very important to watch social media and monitor which platforms are doing well in your company. Diversify and place priority on those platforms as well as Google ads.

Rising customer expectations

61% of shoppers expect brands to tailor advertising experiences to their preferences. In order to do this, utilizing advanced automation when creating ads is. Automation helps advertisers show the most relevant content to each customer through machine learning, improving the user experience.

For example, Google Ads takes past searches and caters advertisements directly to the consumer using its current Quality Score. As a result, advertisers who fail to connect their ads and customer experiences will see lower Quality Scores and higher CPC costs.

Smaller social channels receive a sizeable share of ad spend

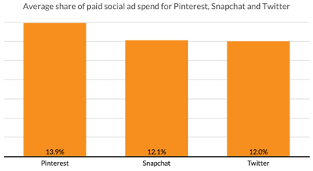

Ad spending is currently being shifted away from large platforms like Facebook and Instagram to smaller platforms like TikTok and Snapchat. In fact, the market saw brands with paid social campaigns reallocating more than 10% of their budgets to Pinterest, Snapchat, and Twitter, with Pinterest increasing nearly 14% overall. This illustrates advertisers’ interest in expanding their paid social programs outside of the Facebook/Google ecosystem.

Organic search skyrockets

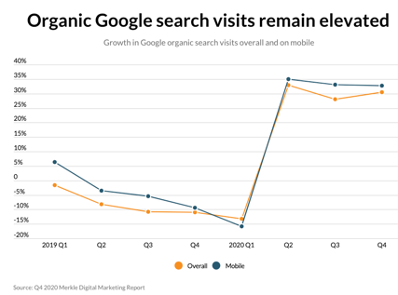

U.S. organic Google search visits continue to skyrocket, growing 30.5% in Q4 of 2020 compared to the previous year. What’s more, mobile search visits grew by 32.7%. While there was a significant increase year-over-year, the quarterly growth flattened, with overall organic Google search visits down almost three percentage points compared with the peak of 33% growth. This influx of organic search in 2021 will significantly impact holiday shopping, and whether in-store or online, will dominate.

Overall, these different trends help to create and diversify your paid media strategy to lower your CPC. It is vital to keep up with trends in the market and know that it is ever-changing and may require adjustments to your strategy.

Partner with Pyxl

Digital advertising can be tricky. Studying algorithms, adjusting to changes in the market, and finding the right place to advertise is a job of its own. That’s why we’re here. Contact Pyxl for your full-funnel digital strategy today!

Updated: Apr 13, 2022

Bonnie Winter

Bonnie Winter

Kati Terzinski

Kati Terzinski Erin Murray

Erin Murray