Change Management Process: Key Steps for PE Firms After Acquisition

Private Equity (PE) firms are known for their ability to identify and invest in companies with growth potential. The acquisition of a new company is just the beginning of a complex journey. To maximize the value of their investments, PE firms often need to implement significant changes within the acquired companies. The change management process plays a critical role in the success of the post-acquisition phase.

When the dust has settled on the deal and the acquired company is now under new leadership; this is when the real work begins for private equity firms. Implementing the strategic vision that justified the acquisition requires navigating complex organizational change across systems, processes, and culture. But without careful change management, deals can fail to realize their projected value.

Poor adoption and alignment lead to 70% of transformations falling short of expectations. For PE firms, change management is imperative after an acquisition to deliberately transition the organization, align stakeholders, and achieve integration objectives. This involves understanding change impacts, mapping dependencies, segmenting adopter groups, planning communications, providing training, and tracking progress through KPIs. Managing the human elements is as crucial as managing the technical elements. By taking a structured approach to change, private equity firms can smoothly integrate acquisitions, accelerate ROI, gain employee buy-in, and position their portfolio companies for long-term success under new leadership.

In this blog post, we will delve into the key steps involved in the change management process for PE firms after an acquisition.

1. Conduct a Comprehensive Assessment

Before embarking on any changes, it’s essential for PE firms to conduct a thorough assessment of the acquired company. This assessment should cover various aspects, including the company’s

- Culture

- Operations

- Financial health

- Market positioning

The goal is to gain a deep understanding of the current state and identify areas that require improvement or transformation.

2. Define Clear Objectives and Goals

Once the assessment is complete, PE firms should define clear and achievable objectives and goals for the acquired company. These objectives, whether they involve revenue growth, cost reduction, or market expansion, should align with the overall investment strategy. Setting specific, measurable, and time-bound goals provides a roadmap for the change management process.

3. Create a Change Management Team

Change management requires a dedicated team with the right skills and expertise. PE firms should appoint a change management leader or team responsible for planning and executing the transformation. This team should include individuals with experience in change management, as well as subject matter experts from within the acquired company.

4. Develop a Change Management Plan

A well-structured change management plan is essential for a successful transition. This plan should outline the strategies, tactics, and timeline for implementing the necessary changes. It should also identify potential risks and mitigation strategies. The plan should be communicated clearly to all stakeholders, including employees, investors, and leadership.

5. Engage and Communicate with Employees

Employees are a crucial part of the change management process. Gaining employee buy-in and support is essential, and this requires open and transparent communication. PE firms should hold regular meetings, provide updates, and address employee concerns throughout the transition. In some cases, training and development programs may be necessary to equip employees with the skills needed for the new direction.

6. Implement Changes in Phases

Change management is often most effective when implemented in phases. Rather than making drastic changes all at once, it’s advisable to break the transformation into manageable stages. This approach allows for better control, evaluation, and adjustment as needed. Each phase should be aligned with the defined objectives and goals.

7. Monitor and Measure Progress

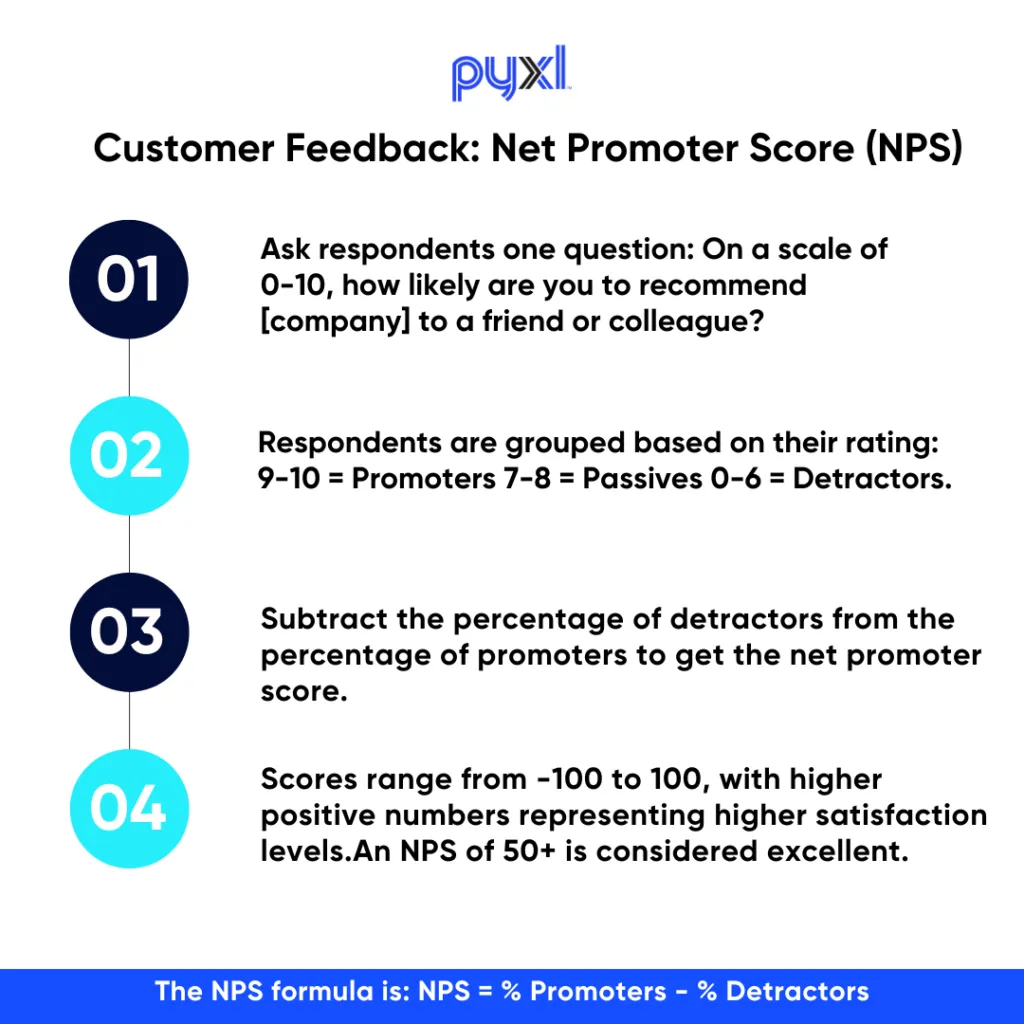

To ensure the change management process is on track, PE firms should establish key performance indicators (KPIs) and regularly monitor progress. KPIs can include financial metrics, operational efficiencies, employee satisfaction scores, and customer feedback. Measurement provides valuable insights into the effectiveness of the changes and allows for course corrections when necessary.

8. Adapt and Evolve

Change management is not a one-time event; it’s an ongoing process. PE firms should be prepared to adapt and evolve their strategies as the acquired company evolves. Feedback from employees, customers, and market conditions should inform adjustments to the change management plan. Flexibility and agility are essential in navigating the changing landscape.

9. Celebrate Achievements

Acknowledging and celebrating achievements, both small and large, is important for morale and motivation. Recognizing the efforts and successes of employees and the change management team fosters a positive culture and encourages continued commitment to the transformation.

10. Evaluate the Overall Impact

Once the change management process has been completed, PE firms should conduct a comprehensive evaluation of the overall impact. This evaluation should assess whether the defined objectives and goals have been met and whether the investment has generated the desired returns. Lessons learned from the process can inform future acquisitions and change management efforts.

Contact Pyxl

Change management is a critical component of the private equity investment cycle. Successfully implementing changes after an acquisition can significantly enhance the value of the acquired company. PE firms that follow these key steps in the change management process are better positioned to achieve their investment goals and ensure the long-term success of their portfolio companies. Effective change management requires strategic planning, communication, and adaptability—a combination that can ultimately lead to a profitable and sustainable investment outcome.

Implementing new technologies, systems, and processes is inevitable for PE firms aiming to maximize value in their portfolio companies. But substantial change brings substantial challenges in adoption, compliance, and stakeholder alignment. An experienced digital transformation agency like Pyxl, is invaluable for guiding firms through organizational change management.

With expertise in communication planning and tracking KPIs, Pyxl can serve as the central driver of change. For PE firms undertaking large initiatives that hinge on adoption success, partnering with the right agency unlocks smoother transitions, faster timelines, and achievement of strategic goals. An expert partnership, like the one we offer, will enable private equity firms to focus their energy on shaping strategy and progressing their digital transformations with confidence.

The stakes are high in the private equity arena, and lackluster change management can erode the value of newly acquired companies. Partnering with experts is key. Pyxl’s change management consultants have guided many PE firms through successful post-acquisition transformations. Let us help assess your needs, craft a tailored change management strategy, and equip your organization to lead a successful transition. With Pyxl as your change management partner, you can implement the strategic vision that makes your next deal a resounding success. Contact us today to get started.

Updated: Oct 27, 2023

Pramita Pramod

Pramita Pramod Kati Terzinski

Kati Terzinski Erin Murray

Erin Murray